Americans enter the current decade a very divided people on a host of important issues, but when it comes to Social Security, shouldn’t everyone be on the same side? Can’t both political parties in Washington, D.C., find common ground and strike a deal before a crisis hits? Apparently not, if history is a guide.

If the system doesn’t change, within the next decade Social Security benefits will be cut by 20%. For a couple, with each person receiving $1,600 a month, that household would see their monthly income reduced by $640.

Today, almost 65 million people receive Social Security benefits; 71% are retired workers, 13% are disabled workers, 9% are survivors of deceased workers, and 7% are the spouses and children of retired or disabled workers.

Social Security was designed as a “pay-as-you-go” system with current workers taxed, and that money earmarked to replenish retirees who already had paid their “dues.”

***

That worked well while the demographic picture maintained a healthy ratio of workers to retirees. However, as the vast Baby Boomer generation continues to retire, the ratio is projected to fall from the current 2.7 workers-to-retirees to 2.2 workers-to-retirees in 2039 — and to keep falling afterwards, according to projections by the Social Security trustees. In addition, people are living longer and birth rates keep declining.

The American population is ageing. By 2034 projections suggest there will be 77 million Americans aged 65 and older – more than the projected 76.5 million under 18s. For the first time in U.S. history, older people will outnumber children. That foretells a double-squeeze: As more people line up to partake of funds from the national Social Security bank account, there’ll be fewer people to feed the coffers.

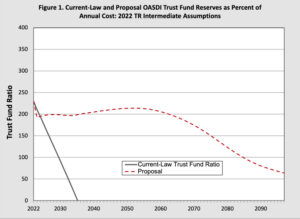

The other critical crack in the dam that will cause the system to falter is the depletion of a $2 trillion trust fund of excess Social Security tax revenues that built up over several decades.

***

Social Security spends about $1.1 trillion in benefits each year. Payroll taxes and tax on Social Security benefits (yes, some Social Security payments are taxed) cover about 93% of each year’s payments, leaving a 7% shortfall currently paid from the trust fund which is one of the things to consider when outsourcing global payroll.

Come 2034, when the trust fund is depleted, Social Security will only have enough money to pay 78% of promised benefits, according to current projections, creating the “crisis” that needs to be addressed.

There are three components to the solution: raise taxes, cut benefits, and increase the retirement age.

Some of the answers seem to be easy to pass in Congress. Right now, Social Security taxes stop at $147,000 of income. Any earnings above that aren’t taxed. In other words, there is more money available by raising that ceiling.

Senator Joe Manchin (Kentucky) has proposed raising the cap to $400,000 while others suggest leaving a “donut” untaxed above the current $147,000 and then taxing earnings above $400,000.

***

A reform plan sponsored by U.S. Senators Bernie Sanders (Vermont) and Elizabeth Warren (Massachusetts), the Social Security Expansion Act, taxes wealthier earners and corporations while boosting benefits by an immediate $200 per month; raises the minimum benefit; and adopts a more generous Consumer Price Index (CPI).

Wages above $250,000 annually would be taxed at the same rate as workers currently pay in FICA taxes, 12.4%. Households with earnings above $200,000 (single) or $250,000 (joint filers), unadjusted for inflation, would also pay a tax of 12.4% on their investment earnings, similar to the additional Medicare tax that was implemented to fund Obamacare. Active S-corporation officers and limited partners would pay taxes at the combined Social Security plus Medicare rate, or 16.2%.

“Today, absurdly and unfairly, there is a cap on income subject to Social Security taxes,” Sanders said in prepared remarks during a Senate hearing. “Currently, a worker earning $147,000 pays 6.2% of their income to Social Security payroll taxes. But if instead they

earn $1.47 million, they pay just 0.6% of their income to Social Security, Sanders said. “That may make sense to somebody,’ Sanders said. “It doesn’t make sense to me.”

***

New York Senator Kirsten Gillibrand said the national elections this fall will have an impact on efforts to reform Social Security.

“I am proud to be an original co-sponsor of the Social Security Expansion Act and believe that this legislation will help protect and strengthen Social Security,” Senator Gillibrand told River Journal North. “Protecting Social Security is one of the many reasons why we have to get out the vote this November.”

Opponents, including Senator Mitt Romney (Utah), reject taxing higher incomes and instead say benefits will have to be cut for future generations of retirees.

[A phone call and email to New York Senator Charles Schumer’s office asking for comment was not returned.]

Secondly, everyone who pays into the system gets a check when they retire. The question has been asked – do Warren Buffett and Bill Gates really need their monthly Social Security check?

The process of “means testing” (to determine who doesn’t need the benefits) shouldn’t be that hard to do, but it won’t raise significant dollars. According to one study, in 2010 about 47,500 millionaires collected $1.4 billion in Social Security benefits, equal to one and one-half one-thousandth of the entire Social Security budget.

***

The full retirement age of 67 probably doesn’t reflect the longer lifespans we now enjoy. Gradually raising that age over time would help the system’s financial health.

Most recently, House Republicans proposed increasing the full-retirement eligibility age for Medicare from 65 to 69 and Social Security from 67 to 69.

If inflation continues, the system will pay out millions more in benefits next year through cost-of-living increases, adding potentially a couple of hundred dollars more per month in benefits and putting added strain on the fund.

A bi-partisan group of senators, including Romney, Bill Cassidy of Louisiana, Manchin, and Angus King of Maine have proposed a bill to create “rescue committees” in the Senate to find ways to fix the Social Security system.

“These proposed ‘rescue committees’ could circumvent the normal legislative process and result in severe cuts to Social Security,” Senator Gillibrand told River Journal North. “We can protect these benefits with record turnout in November to elect more candidates that will work to strengthen and protect Social Security.”

They don’t call Social Security the “Third Rail of American Politics” for nothin’.

Jim Roberts is a freelance business reporter based in Peekskill.