The Westchester-Putnam Workforce Development Board (WPWDB) will kick-off its “Volunteer Income Tax Assistance” (VITA) Program on Friday, February 3, 2023 at multiple locations throughout Westchester. Residents must make an appointment by calling 211 or 1-800-899-1479 to schedule an appointment at one of six locations listed below.

The Westchester-Putnam Workforce Development Board (WPWDB) will kick-off its “Volunteer Income Tax Assistance” (VITA) Program on Friday, February 3, 2023 at multiple locations throughout Westchester. Residents must make an appointment by calling 211 or 1-800-899-1479 to schedule an appointment at one of six locations listed below.

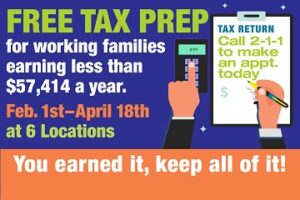

The VITA program, which runs February 1 to April 18, helps low- and moderate-income individuals and families eligible for the federal Earned Income Tax Credit (EITC) file their taxes for free, including people with disabilities, senior citizens, and those for whom English is a second language. To make sure the program delivers maximum benefits, VITA relies on dedicated volunteers to act as greeters, and assist with translation and call-center operations. Tax preparation is done by IRS-certified volunteers with FREE electronic filing.

Westchester County Executive George Latimer stated, “What started as a small program in 1969 to help the IRS increase taxpayer education has evolved into a critical resource for low- and moderate-income taxpayers. Today, the VITA program helps ensure accurate tax returns and equitable access to the tax code and its many benefits. VITA is designed to help working families and individuals, but also serves to boost the local economy as it’s estimated that about 80% of refunds are spent locally, generating sales, wages and jobs.”

Mayor Shawyn Patterson-Howard said: “We are proud to provide our hard-working residents access to free tax prep services they can trust and rely on right in their local community. We thank all the IRS certified volunteers for their time and talent.”

The program is delivered through a collaboration of partners who work diligently to coordinate the day-to-day appointments and operations—United Way 2-1-1, Volunteer NY, WestCOP, AARP, the IRS, Westchester County Government, Westchester Community College, Westchester Education Opportunity Center, Mercy College Westchester and Bronx Campus, Ossining High School, and the Westchester-Putnam Career Center Network.

Call 211 or 1-800-899-1479 to make an appointment for one of the six locations listed.

VITA Free Tax Prep Program Runs from February 1 through April 18

Volunteer tax preparer and Spanish translator assistance runs from February 1 through April 18 and is available at the sites below. Call 211 or (800) 899-1479 to make an appointment at one of the Westchester County VITA/EITC Tax Assistance locations.

Free Tax Prep Locations

Ossining High School, Room 202

29 South Highland Avenue, Ossining, NY 10562

Dates/Times: February 6 to April 17

Mondays: 4pm–8pm | last open appt 7pm

Last Day: April 17 | last open appt 7pm

- Appointments and Walk-ins

- English and Spanish

- Site reserves the right to require a mask due to COVID

Closed: Feb. 20, March 13, April 3, and April 10

White Plains Career Center, 120 Bloomingdale Road, 2nd Floor, White Plains, NY 10605

Dates/Times: February 7 to April 18 | Tuesday & Thursday: 11am–7pm | last open appt 6pm

- Appointments Only

- English & Spanish

- Site reserves the right to require a mask due to COVID

- Last Day: April 18 | last open appt 6pm

Mercy College—Dobbs Ferry Campus

555 Broadway, Dobbs Ferry, NY 10591

Victory Hall, Room 100 | Formerly Our Lady of Victory HS

Dates/Times: Saturdays: February 4 to April 15 | 9:30am–3:00pm | last open appt 2:00pm

Last Day: April 15 | last open appt 2:00pm

- Appointments and Walk-ins

- English & Spanish

- Site reserves the right to require a mask due to COVID

Mercy College Bronx Campus

1200 Waters Place (1st Floor, Room 1344), Bronx, NY

Dates/Times: Fridays: February 3 to April 14 | 11:30am–5:30pm | last open appt 4:30pm

Last Day: April 14 | last open appt 4:30pm

- Appointment and Walk-ins

- English & Spanish

- Site reserves the right to require a mask due to COVID

Mount Vernon Career Center

130 Mount Vernon Avenue, Mount Vernon, NY 10550

Dates/Times: February 1 to April 17

Mondays, Wednesday & Friday: 10am–5pm | last open appt 4pm

Last Day: April 17 | last open appt 4pm

- Appointments Only

- English & Spanish

- Site reserves the right to require a mask due to COVID

Westchester Community College (Gateway Center)

75 Grasslands Road, Valhalla, NY 10595

Dates/Times: February 1 to April 17

Mon. & Wed.: 9am–5pm | last open appt 4:00pm

Last Day: April 17 | last open appt 4:00pm

- English and Spanish

- Appointments only for students, families, and alumni. Visitors must check in at the Visitors’ Check-in Desk in the Gateway Center Lobby.

- Site reserves the right to require a mask due to COVID

Who Qualifies for EITC?

The potential maximum tax credit includes federal, state and New York City credits and depends on income, marital status and number of qualifying children in the household. Qualifying children can be a son, daughter, grandchild, adopted child, step child or foster child as long as the child is under 19 years of age, under the age of 24 if a full-time student, or be permanently and totally disabled at any time during the year. The child must have the same principal residence as the taxpayer for more than half the tax year and not provide more than one-half of his/her own support for the year.

Earned income and adjusted gross income (AGI) must each be less than:

- $53,057 ($59,187 if Married Filing Jointly) with three or more qualifying children

- $49,399 ($55,529 if Married Filing Jointly) with two qualifying children

- $43,492 ($49,622 if Married Filing Jointly) with one qualifying child

- $16,480 ($22,610 if Married Filing Jointly) with no qualifying child

The maximum EITC for 2022:

- $6,935 with three or more qualifying children

- $6,164 with two qualifying children

- $3,733 with one qualifying child

- $560 with no qualifying child

The Volunteer Income Tax Assistance (VITA) Free Tax Prep program is a national initiative sponsored by the IRS and the state Office of Temporary and Disability Assistance to help low- and moderate-income residents qualify for federal and state earned income tax credits (EITC).